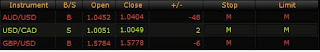

The FOMC meeting and the USD Rate statement are going to be the market-movers this week, as they have in the past. I believe that these would fuel risk and power the AUD, EUR, CAD and NZD against the greenback. Hence, I am preparing to take positions to BUY the EUR/USD, AUD/USD and the NZD/USD and then SELL the USD/CAD.

The EUR/USD broke through the 1.34 level last week and appears to be aiming for 1.35. However, it is high on the hourly Bolinger Bands and RSI. So, I am waiting a couple of days and let the profit-taking settle it before entering a BUY position.

A hammer formed on the daily AUD/USD pair - a sign that the selling may be over and the AUD might strengthen against the dollar. With a slew of US economic indicators due this week expected to print with positive numbers, risk could provide this pair the upward momentum. Technically, the pair is oversold as suggested by RSI, Slow Stochs and the Bollinger Bands.

The USD/CAD is due for a reversal - it has been walking the upper Bollinger Band into overbought territory. Expectations of good US numbers printing could fuel risk into the CAD as more US production means more orders for Canadian oil.

Dark clouds of a looming currency war are forming - Japan two weeks ago announced a massive infusion into the Japanese economy which weakened the Yen against a basket of currencies and the Swiss National Bank came out with guns blazing to hurl the EUR/CHF about 400 pips at the start of the year.

Who will fire the next blow?

The FOMC and Rate statements this week could provide clues.

-